Depreciation schedule excel formula

Straight line depreciation method is useful when the value of an equipment decreases in a specific pattern and to prepare this schedule you need to calculate the salvage. Rate 1 - salvage cost 1 life To calculate depreciation in each.

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

The depreciation amount that needs.

. Calculate the depreciation to be charged each year using the Straight Line Method. The depreciation value can be calculated using the below formula. I am working on a project for calculating depreciation and having trouble changing my formula for depreciation expense to an IF formula.

While every effort has been made to ensure accuracy of formulas if you. For the Double-declining-balance schedule for the annual depreciation for the 4th year use a formula that will reduce the book value to the salvage value. For example to calculate the depreciation between the 2nd and 4th years of an asset with an initial cost of 20000 a useful life of 5 years and a salvage value of 4000 the.

Formula SLN cost salvage life The SLN function uses the following arguments. Learn more about various types of depreciation methods. If you have an asset that cost 1000 and has a residual value of 100 after 5 years you can calculate the declining balance depreciation of the asset during year 1 as follows.

Depreciation Cost - Residual Value Useful Life. Under the MACRS the depreciation for a specific year j D j can be calculated using the following formula where C is the depreciation basis cost and d j is the depreciation rate. This calculator uses the same formulas used in the Depreciation Schedule where depreciation is calculated without using the MACRS half-year mid-quarter or.

The template calculates the Rate of Depreciation applying the following formula. To get a rate to use to calculate depreciation based on fixed-declining balance Excel uses the following formula. To calculate the depreciation using the sum of the years digits SYD method Excel calculates a fraction by which the fixed asset should be depreciated using.

I understand that the test should be. The fixed assets balance value equals the cost less the accumulated depreciation. Depreciation Per Year Cost.

1 - Scrap ValueAsset Value 1Life Span In the end the template displays the depreciation schedule. Depreciation Per Year is calculated using the below formula. DDB uses the following formula to calculate depreciation for a period.

Min cost - total depreciation from prior periods factorlife cost - salvage - total depreciation from. FY13 FY14 FY15 FY16 CAVEAT. The units-of-production method of depreciation does not have a built-in Excel function but is included here because it is a widely used method of depreciation and can be.

Cost required argument This.

Macrs Depreciation In Excel Formulas To Calculate Depreciation Rate Excel Formula Excel Calculator

Preparing Fixed Asset Capex Forecast Model In Excel Depreciation Nbv Calculations Pakaccountants Com Fixed Asset Excel Tutorials Excel

Excel Salary Sheet With Formula By Learning Center In Urdu Hinidi Learning Centers Excel Learning

Calculate Depreciation In Excel With Sln Straight Line Method By Learnin Learning Centers Excel Tutorials Excel

Balance Sheet Template Download Excel Worksheet Balance Sheet Balance Sheet Template Fixed Asset

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping Bookkeeping Templates Accounting Basics Learn Accounting

Macrs Depreciation Table Excel Excel Basic Templates

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Depreciation Schedule Template Depreciation Schedule Irs Depreciation Schedule Excel Template Depreciation Formula Depreciation Schedule Pdf Fixed Asse Hubungan

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Computer Generation Excel

Capital Expenditure Report Template 1 Professional Templates Budget Template Free Budget Template Excel Budget Template

Property Plant And Equipment Schedule Template Excel Schedule Template Financial Analysis Finance Career

The Sum Of The Years Digits Method Of Depreciation Accounting Education Learn Accounting Sum

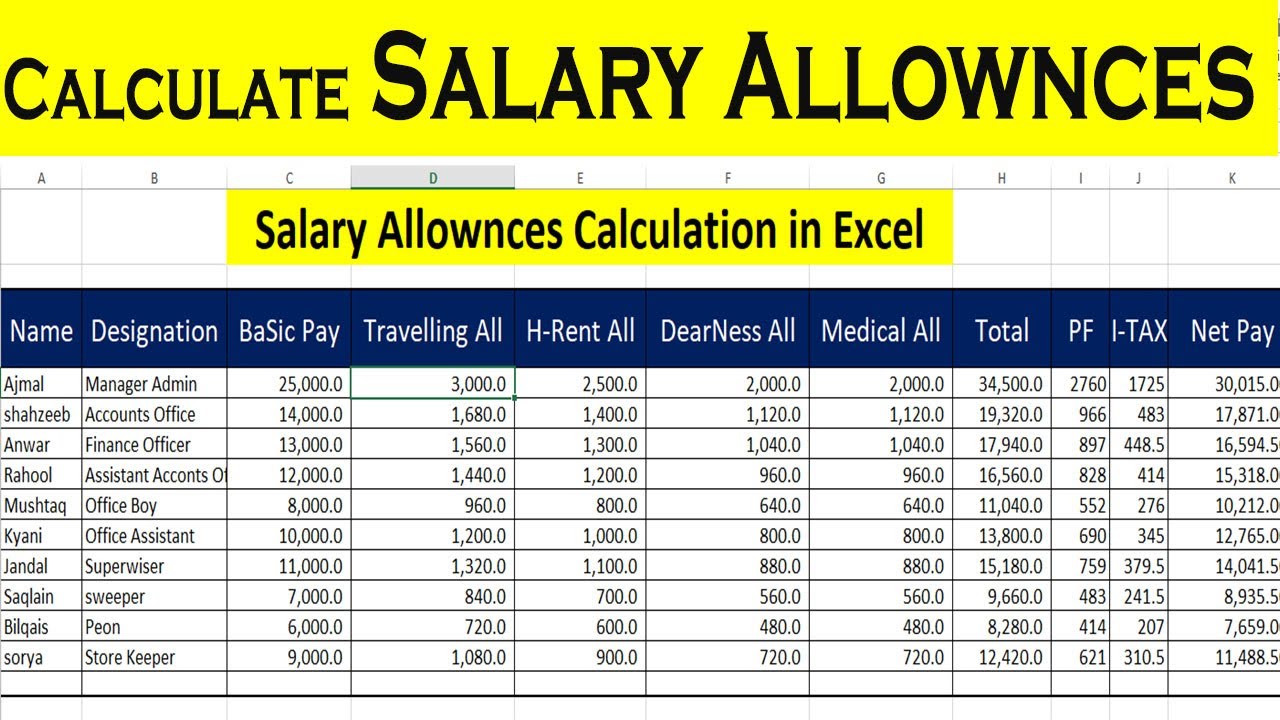

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions

Calculate Depreciation In Excel With Sum Of Years Digits Method By Learn Learning Centers Learning Excel